Metiza

“All in all, a new, highly complex and destabilised ‘domain of risk’ is emerging – which includes the risk of the collapse of key social and economic systems, at local and potentially even global levels. This new risk domain affects virtually all areas of policy and politics, and it is doubtful that societies around the world are adequately prepared to manage this risk. Due to the high levels of complexity, the scale of breakdown and systemic nature of the problem, responding to the age of environmental breakdown may be the greatest challenge that humans have faced in their history.”

IPPR – This is a crisis, facing up to the age of environmental breakdown

“It is not hard to see that these foreseeable catastrophes (glaciers melting within Central Asia) could lead to mass migration and even war on the Eurasian continent this century. The geological effects will start kicking in by in the middle of the century (which is only 30 years away) but the political effects are likely to hit much earlier, as those dramatic changes are being anticipated.”

“I expect the next really serious oil price spike to hit sometime in the early to mid-2020s, and it’s likely to be a doozy. Make your preparations now and you’re going to be in much better shape when the economy gets whacked again.”

John Michael Greer – “February 2019 Open Post”

Over the last few years I have covered, on this blog, the rise of populist politics across the developed world, the growing risk of resource scarcity, the impact of a changing climate and the cultural and economic impact of demographic shifts and how these various dynamics will interact in the coming decades.

Long-term readers of FI will already know that the combination of climate change and growing scarcity of fossil fuels, fertile land and water across the tropics will trigger a rising cascade of crises, civil wars and eventually mass migrations into the cooler northern and southern hemispheres.

Mass migrations in the coming decades will be a symptom and trigger of a wider global economic crisis, as economic growth across the world withers away and growing parts of the world tip into a new world of permanent economic contraction.

Resource, geopolitical and climatic driven disruption, whether the rise of sea levels destroying coastal ports and cities, civil war in resource-rich states or the rise of nationalist strongmen who hoard key resources rather than allow them to be traded on the globalised market will strangle our globalised free market economy over the longer-term.

Within the context of this global story of the early decline of our industrial civilisation is the change of wealth and power on the international stage as the great Asian powers rise and the old Western world declines. Angst within the ruling elites of Europe and America about the future is ripe, with American policy elites waking up to the technological threat posed by China. Washington is now attempting to force their allies to ban the Chinese company Huawei from developing the next-generation 5g infrastructure. This may already be too little too late.

In Europe, a recent De Spiegel article focused on the growing threat posed by China to the mighty German economy with respect to electric cars. As the magazine noted “…according to P3’s predictions, two Asian companies will dominate the market by the middle of the coming decade: China’s CATL and South Korea’s LG Chem. The two companies will, according to forecasts, make up one-quarter of the global market. The rest will fall to manufacturers located mostly in China, South Korea and Japan — but not Europe.” Belatedly, after years of failing to invest in new technologies or infrastructure, the German political and economic elites are waking up to the fact that China is on course to displace Germany as a major industrial exporter.

It isn’t just in the economic or technological field that West is falling behind. Geopolitics also reflects this shift in power from the West to the East. The future of Syria, where President Assad has de facto won the civil war, will be decided in the capitals of Moscow, Istanbul, Tehran and behind-the-scenes, Beijing, not Washington, London or Paris. This is our new world order in action today.

So, what is a reader supposed to do with all this information, data and analysis? Here are my recommendations on things you can do in the coming decades to survive, mitigate and take advantage of the changes coming.

Stay healthy

To put it plainly, keeping physically and mentally healthy will become vital in the decades to come.

I haven’t discussed as much as I should the potentially shocking implications of the unraveling of our industrial health care systems and how even the common cold could become a lethal killer a generation or so from now.

One country is a harrowing example of our potential future. Venezuela’s healthcare and health research infrastructure has fallen into a state of collapse as a consequence of the wider socio-political crisis which also has a deeper energetic dynamic not covered by mainstream coverage of the country.

According to this article, there are “…over 400,000 cases of malaria in 2017, 15% of the rural population infected with Chagas disease, surging dengue, Chikungunya and Zika infections.” The huge migration of desperate Venezuelans into neighbouring countries raises the risks of regional wide pandemics, particularly, those refugees centred in the impoverished urban shanty towns.

Imagine a future world, let’s say the late 2030’s, where you have half a dozen Venezuela’s across the world going on simultaneously. Despite the best efforts of wealthy countries, the WHO and other international bodies, it is stretching the imagination to think that these issues can be contained indefinitely. At some point, major pandemics will become inevitable, leading to huge disruption of global and regional supply chains, international tensions and the closure of borders to refugees.

So, if you can, maintain a healthy diet, keep active and take care of your body. I would also recommend that you find ways of strengthening your mental fortitude because the coming decades will be a grim cocktail of depressing news and disruptive events. Whether that is gardening, walking, meditating or prayer or something else, it is advisable to cultivate healthy methods rather then go down the path of becoming addicted to legal or illegal drugs, alcohol or gambling like so many already.

Consider moving

The bulk of my blog readership live in either the outer edges of the northern or southern hemispheres (e.g. Europe, North America, Russia or Australasia) but for those who live around the tropics, in particular North Africa or the Middle East, I would strongly recommend moving.

Quite frankly, your part of the world will become uninhabitable to large-scale human life within a generation. Either you die, move now or attempt to move later when panic sets in.

Gideon Rachman, in the Financial Times, recently wrote about the growing tensions within the Muslim and non-Muslim worlds. The emerging superpower, China, has interned over a million Muslims as a national security measure after a series of terrorist attacks by the Uighur extremists. Rachman writes that fear of Islam “is now a central part of politics in most of the world’s major power centres — from the US to the EU, China to India.”

Given the rise of hard-line Islamic fundamentalism across the Muslim world it is therefore sensible, if you are a Muslim living within that vast band of the tropics, to consider whether those power centres will tolerate future migrations from Muslim majority countries into their homelands.

You would be better off moving now before the doors shut for good.

For those of my readership who live on the future frontlines of this crisis, whether that is in southern Europe, south-west America and northern Australia moving should also be a major consideration. As a rule of thumb, if your part of the world is already impacted by refugee flows, its going to get far worse in the future.

Those who live within coastal regions should be worried too. Rising sea levels will destroy the value of properties exposed to flooding and force internal migrations in the future. Florida is a good example of a state that is already dealing with this challenge. My recommendation is to move to higher ground when you can still sell and insure your home should you reside in a low-lying area.

You should also consider the wider sustainability of your locality. If you live in a sky-rise penthouse in New York is that going to be the best place in say 30 years from now? It might be sensible to move to a large town with a farming hinterland with access to jobs, public transport and provide the opportunity to be less dependent upon the industrial system for your survival and subsistence. Within the UK, market towns and small cities are better places to live than some of the grimmer and dangerous large cities like London, Birmingham and Manchester where a crime wave is already occurring.

One will also need to factor in community. Whilst it is hard to generalise, you will want to live within a shared community that helps each other out, where neighbours aren’t strangers and is reasonably safe. You certainly don’t want to reside somewhere that resembles, at worst, a low-level warzone because it is likely to get worse, not better, in the future as our industrial civilization declines.

Develop skill sets and multiple income steams

Since the post-war years, a good rule of thumb is that if you have gone to university, specialised in a professional career and climbed the rat race you would have done well. I’m sure many of my readership, including myself, have a specialised professional career niche which provides a comfortable income.

John Greer was written before that every complex civilisation developed economic niches which were colonised by the educated classes, whether these were the scribes within the Roman Empire or the professional niches within our own industrial civilisation – marketing to give just one example.

Civilizations in decline aren’t able to justify these expensive economic niches, and slowly but surely these jobs will get terminated, taking the middle classes with them. So, what do you do, reader? After all, we can’t all become plumbers, gardeners and hairdressers!

Given that I’m in the same boat here, I’ve given it much thought over the years. Ideally you should retrain your career into something that is more sustainable long-term but if that proves difficult or impossible, here are my suggestions.

First, try and clear any debts you have, in particularly mortgage debt which is the main debt for the average citizen of the developed world. If you are able to retrofit your home to reduce your expenses long-term through insulation, rainwater systems and maybe solar panel, you should be able to live with minimal expenses once the mortgage is paid off. At the very least it will give you peace of mind.

Secondly, you should cultivate skills which will prove useful and popular in the future. That could include gardening so that you can barter food with friends and family, brewing beer, sowing, massage or martial arts to give just a few examples. These skills could also provide income streams in the future which may prove a godsend if you are out of work for a while.

Thirdly, you should try and develop alternative income streams apart from your day job. This could be dividends from blue-chip stocks, or rental from a buy-to-let property or a hobby that provides capital return (doing up classic cars and selling them for a profit). Over time those modest income streams will grow in value and will provide future opportunities, if and when, your bread earner job disappears.

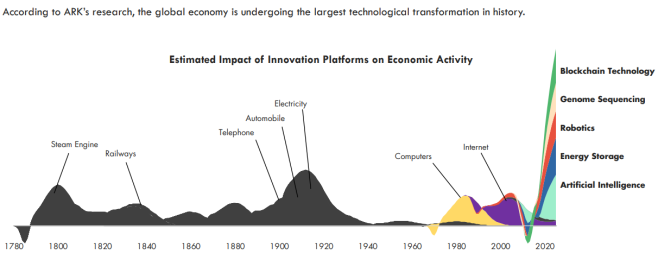

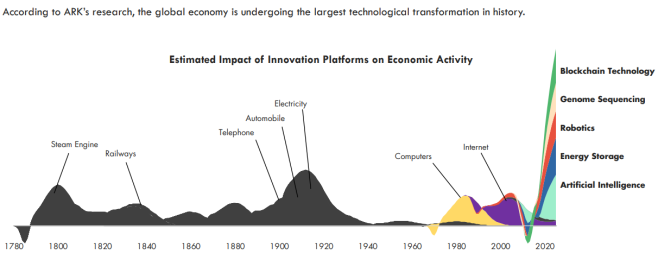

I have written before of the likely technological disruptive changes looming in the next decade, specifically the blockchain revolution, AI and robotics. This Ark hedge fund graph is a striking visual take on what technological forces could disrupt our world within decades.

Ark Invest

Opportunities exist to take advantage of these disruptive changes as anybody who brought Amazon stock in the early 2000’s could confirm. In late 2017, I noted the crypto token Ripple when it was only 20 cents. Those readers who had acquired the token shortly after I had noted it within my cryptocurrency blog post could have sold it for over 10 times more within a few months.

I take the personal view (and I’m not an investment adviser) that there are opportunities within the crypto/blockchain space which I have recently discussed here. The point is that whilst we are in the early stages of a long-term decline and eventual collapse of our industrial civilisation, for the foreseeable future companies will carry on innovating, trillions of wealth will carry on sloshing around our globalised economy and life will carry on.

If you are prepared to take the risk, have funds to spare and are interested there are opportunities to grow your wealth and over time, hopefully, convert that into income yielding assets which will help you weather the future storms coming our way.

Embracing simplicity

One of the biggest challenges facing anybody who is prepared to consider the challenges I write about in my FI blog is the psychological hit to our internalised “progress” mythology that permutates our societies.

The underlying assumption is that we, that is humanity, will carry on “progressing”, overcoming any challenges and that growth will carry on forever. John Greer wrote a brilliant book on this subject called “After Progress: Reason and Religion at the End of the Industrial Age” which I highly recommend. The high priests of this secular religion are the men (they are usually men anyway) in white coats, working in hi-tech labs, who will save us from our self-inflicted problems.

Accepting that we are not progressing but in most aspects are now declining is a profoundly humbling challenge for many of us. In truth, it takes years to internalise that message but it is worth it.

Why? Because it is this faith, and that is what it is if you are honest, that “they will come up with something” that stops us from changing our lifestyles and planning for the inevitable shocks that will shatter our world this century.

The long-term challenge is to embrace simplicity. Grow food within your own garden, recycle, make and mend, try and use public transport and other sustainable forms of transportation and enjoy the free and simple things in life; a nice walk in the countryside, playing card games with your friends and enjoying home brewed beer with friends.

This is a normal way of life for the majority of the globe and they aren’t necessarily unhappier because of it. If you embrace rather then resist the inevitable shift to a more basic way of life you will be better off, materially and spiritually as a consequence.

Managing political risk

One of the darkest aspects of the coming decades of disruption is that potential negative political impact which could affect you and your family. It is a common pattern in a declining civilisation that you see the emergence of Caesars, charismatic strongmen who rise to power, something that Oswald Spengler predicted in his prophetic book “The Decline of the West” in the 1920’s.

History is also a good guide to what also can happen to minorities, particularly ethnic or religious minorities during periods of political and economic trouble. So, what do I see as the most likely fault lines and political risks in the coming decades with a focus on the developed world?

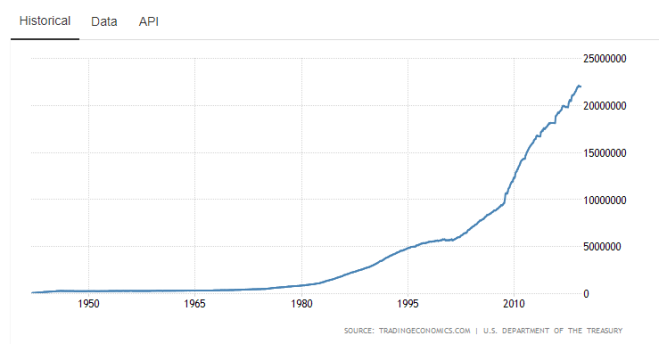

Well the first is the rise of the populist left with a focus of swinging wealth taxes of the wealthy across the developed world as economic growth withers away, the costs of maintaining our welfare systems skyrocket and government debts balloon. If you are rich expect governments across the world to target you via various forms of direct and indirect taxes.

I will be writing soon on the impact of the above trends on the low-tax offshore finance centres (also known as “tax havens”) where many of the super-rich have started fleeing to in recent years. It won’t be easy to avoid the return of wealth taxes but it probably can be mitigated if you wish.

The shocking return of anti-Semitism within the UK Labour party and within the progressive wing of the US Democratic party is an example that the oldest form of hate is still very much with us. Sadly, political risk will be of acute concern to Jewish readers of this blog who will need to navigate two main risks going forward; the rise of violent anti-Semitic Islamist ideology and the less violent but equally unpleasant emergence of a hard-left “anti-Zionist” hatred that quickly morphs into anti-Semitism.

Jewish people are physically most at risk from jihadi extremism with old-school far right extremism now only a residual threat. After all, the French nationalist leader Marine Le Pen now considers herself and her rebranded National Front party a friend of the besieged Jewish community. The wider re-emergence within polite society of anti-Semitism is a worrying development and should concern the Jewish community.

My recommendation to any Jewish readers would be to move to places where there is little anti-Semitism and Jewish communities can reside and practise their faith in peace.

Political risk can also include the emergence of authoritarian regimes, even in places that were once democratic and counter intuitively the loss of state power with risks of rising crime and civil disorder. Apart from trying to avoid likely places of trouble it is hard to give specific advice on this area given the future variables are so hard to foresee. Still, as a general rule, consider moving if you already live in places of racial/religious tension and/or there is a high crime rate e.g. major cities within western Europe and parts of America.

Overall, the coming generations of change will reshape everybody’s life to a lesser or greater extent.

Wise folk will start thinking and planning now before panic sets in…