NPR

“Despite the claims still retailed by the increasingly ragged chorus of believers in perpetual progress, industrial civilization is no longer progressing. Rather, it’s slipping bit by bit down the trajectory I’ve titled the Long Descent—the process, averaging one to three centuries in length, by which every previous human civilization has ended in a dark age.”

John Michael Greer – “The Dark Places of the Future”

I was in Goa when the New Year celebrations commenced and it was certainly good fun! But whilst I enjoyed the party, the truth is that I have a sense of growing dread about what is coming down the track for our industrial civilisation and, to quote Mr Barnier, how the clock is ticking for me and everybody else on this slowly sinking Titanic.

Travelling around India was a fascinating holiday and a true eye opener into the day-to-day existence of a developing country. Regular electricity blackouts, horrific air pollution in the cities, immense poverty and vast slums where millions scratch out a living in heavily populated mega-cities.

One of the most illuminating conversations I had with our tour guide, a highly educated Hindi, was over his fears for the future of the country. India is facing huge water shortages within a decade and he was searching for a place in India which could act, in his words, as a safe haven for his family in the future.

Despite the vast progress India has undoubtedly made in the last decades, and will do so for the foreseeable future, the Limits to Growth mega-trends of resource scarcity, water shortages and an increasingly unstable climate are going to lead to a “perfect storm” by 2030 or so. The scenario painted by the Population Institute in their 2030: The Perfect Storm Scenario looks frighteningly realistic given the trajectory India is heading; a major economic, societal, political and energetic crisis within the next 15 years.

And it isn’t just India. We are all, to a lesser or greater extent, in the same boat although the Long Descent will impact different regions in different ways over the rest of the century.

2019 in the broadest sense, can be seen as another step down that jagged path of decline, partial recoveries and further decline, of our industrial civilization. To paraphrase John Greer in his superb 2019 review, our collective future will be dealing with the increasingly dire consequences of an industrial civilisation past its peak.

Long-time readers know that the beginning of the year is when I review the performance of my predictions for the previous year which you can read here.

I scored a winner with my forecast of a major volcanic eruption which would cause major economic disruption. The Kilauean volcanic eruption in May caused catastrophic damage to homes and businesses and led to Hawaii losing out on about $480 million in tourist dollars.

When making my 2017 forecasts I over-estimated the political fortunes of populist forces during the Dutch and French elections. As a consequence, I swung too far the other way in my 2018 prediction of the Italian elections and consequently under-estimated the stunning electoral triumph of the League and Five Star populist parties in the March 2018 elections who went on to form a coalition government.

Still I did get some of it right, correctly analysing that the electorate wanted a “strong hand” to deal with the refugee crisis and that the new coalition government would be Eurosceptic. So, I will give myself 50% for this one.

The highly volatile crypto asset market has proven to be a roller coaster in 2018 but not in the direction of travel I anticipated at the beginning of the year. Bitcoin, the lead crypto asset, continued its decline throughout the year and the overall sector remains mired in a bear market. Both my bitcoin and Ethereum price predictions were proven spectacularly wrong.

I anticipated that the barriers to the involvement of institutional money into the emerging crypto market would open by the end of 2018 leading to a price recovery of the top crypto assets. Whilst my timing is clearly wrong, and I didn’t expect such a brutal bear market, my medium-term outlook remains bullish about cryptos.

The institutional infrastructure will be in place by mid-2019 for major Wall Street firms, family offices and wealthy investors to easily buy and sell crypto tokens. My own view is that I do not expect to see a return of a crypto bull market until 2020, and unlike the 2016-17 bull run the potentially huge profits will be centred on a small number of quality crypto plays (readers who wish to read more are advised to go to websites like Palm Beach and Investing Haven which specialise in this sector).

I scored a bullseye on my prediction of a major rise in the oil prices in 2018 with tighter supply and sanction-driven fears sending oil to my forecast price of $80 on 17th May. Whilst the oil prices have temporarily dropped since then, I remain confident that commodities as an asset class are in the early stages of a renewed super cycle which will be positive for those invested in the currently unfashionable commodity stocks space.

The victory by the Democrats in re-taking the House of Representatives from the Republicans during the mid-term elections was a clear sign of a backlash from liberal America against the Trump White House. I initially wrote in my post that “…I was reasonably convinced that a surge of liberal, anti-Trump voters in the mid-term elections would end the Republican Party’s control over the House of Representatives”. However, influenced by John Greer’s slightly ambivalent forecast at the beginning of the year and the clear signs of a booming economy, I was swayed by the logic that the better economic climate would save the GOP. This is one I clearly got wrong however my mitigating plea was that my initial instincts were right.

So that’s another year gone in forecasting which I performed reasonably well despite a few howlers, what about the future? This year I wish to do things slightly different with my aim of consolidating in one post my long-term outlook which will also include specific forecasts for this year in bold.

Forecasting is a tough job and my thinking has evolved on certain issues since I started blogging in 2016. For example, when I wrote my “winter is coming” post, I discussed why I thought that the euro would collapse within the 5 years of that post (e.g. 2021 at the latest).

Since then, I’ve reached the conclusion that this is unlikely to happen, given the majority support for the eurozone across member-states among both the general public and elite opinion. Similarly, whilst the European Union (EU) is facing increased deadlock, the rise of populist and nationalist forces hostile to further integration, for deep seated political and economic reasons, its likely that the EU will survive as an entity in the coming decades.

For ex-Warsaw Pact states, the EU has been a source of funds but more importantly a recognition that they have become fully European after the horrors of long-term Soviet occupation. In southern Europe, membership of the EU is seen as a guarantee that they will not revert back to bad old days of fascist dictatorships. The common thread is that the EU is a form of escape by Europeans haunted by their own past.

Britain, the victor of WW2 and the liquidator of one of the greatest empires in world history, had no such historical escapism when it joined the EU. We joined, primarily, for self-interested economic reasons when Britain was known as the “sick man of Europe”. When the 2016 referendum of whether the UK should remain part of the club occurred, a narrow majority of British voters decided that for economic and security reasons the country was better of outside the EU (an outcome that I predicted in January 2016).

The Brexit negotiations have descended into farce and turmoil in Westminster amid widespread popular revulsion against the political class across the political divide. The Hard Brexiteers within the Conservative Party voted against Prime Minister May’s semi-soft Brexit deal along with the opposition parties ensuring that May’s deal, as currently constituted, is almost certainly dead.

Whilst a no-deal Brexit remains the legal outcome should the UK Parliament fail to agree the withdrawal deal there is widespread opposition from within the predominately pro-European MP’s to a no-deal outcome. The situation is fluid and highly volatile but my forecast (60% probability) is that Britain will leave the EU (in 2019) and on a semi-soft/softish terms once a 11th hour amendment to May’s deal is agreed between the government, parliament and the EU. I suspect that this will involve concessions on the so-called Irish backstop by the Irish/EU side, firmer provisions on UK labour rights and amended wording within the political declaration pushing the UK towards a permanent custom union.

A no-deal or no-Brexit outcome remain tail-end risks but not my base scenario. In the longer term, I expect to see a major economic crisis facing the eurozone once the ECB stop purchasing government debts. The eventual solution, once the political resistance from the German-led bloc fades, will be the full-scale monetization of European sovereign debt by the ECB to avoid a collapse of the euro. This crisis, likely by the early 2020’s, will ensure the eurozone survival into the “perfect storm” period of the early 2030’s, after which all bets are off!

I have written recently about how demographics, resource depletion and the growing climate instability amidst a warming planet will end our globalised economic order within decades. Transitioning from an era of economic growth to economic contraction will cause enormous disruptions within the global body politic, akin to a collective nervous breakdown by both the elites and the general public across the world. If that doesn’t make you feel nervous readers, then nothing will!

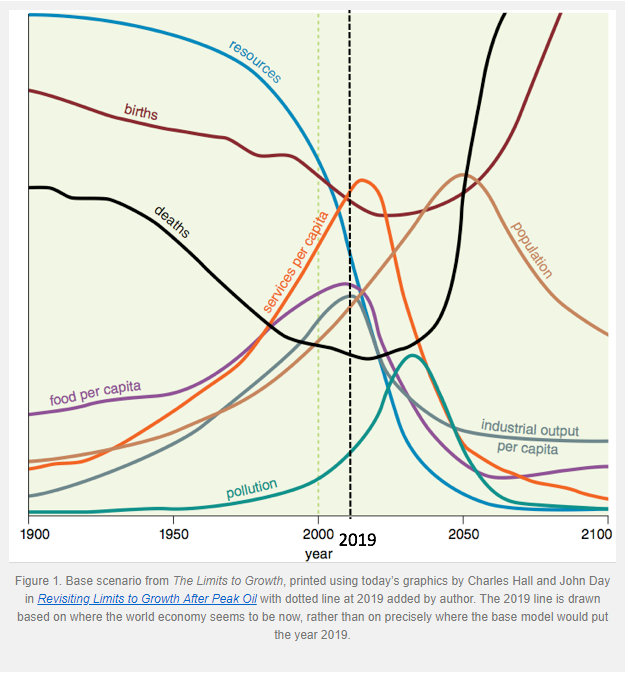

Gail Tverberg, a long-standing writer on economics and resource scarcity, recently published a fascinating update on the Limits to Growth mega-trend which I wrote in some detail in 2016 in my post “winter is coming”. She has attempted to update where we currently are within the BAU Limits to Growth modelling which is approximately 5 years “behind schedule” in the decline of our industrial civilisation (e.g. we are doing slightly better then where the modelling expected us to be vis v vis 2019).

Our finite world

As you can see yourself, according to my rough calculations, we should expect a major economic crisis by early to mid-2020’s once services, industrial and food per capita peaks and rolls over. John Greer has written before that he expects various smoke and mirror fiscal and monetary magic by our politicians and central banks to hide this economic reality going into next decade but at some point, around 2030 will be an historical turning point for the world as we transition into a world of permanent economic contraction.

At the same time that the world faces worsening resource scarcity, please read here for an excellent review of this subject, the climate will continue to heat up. Reading the Sunday Times the other weekend, I discovered a remarkable map on when the coldest year in the future will be warmer than the hottest year in the past prior to 2005.

Sunday Times Magazine

This dovetails with the analysis of Nafeez Ahmad whom I quote in my review of his book;

The world is seeing a “new normal” of extreme weather events, summer heat waves, wildfires, droughts, floods and extreme rainfall which is increasingly common throughout the world. The climate system is being fundamentally transformed, a “climate departure”, which means that within the next decade in the tropics (e.g. encompassing parts of the Middle East, Asia, Central Asia, South Asia and Africa) this will become the new normal, rendering the vast region uninhabitable by 2030-2040, due to prolonged heat waves and dust-storms.

When I was in Mumbai, we did a street food tour and the boys who were guiding us noted that the heat during the summer could be unbearable. Mumbai’s climatic departure is in 2034. According to statistics in 2011, 12 million people lived in the mega-city, and the real number is certainly higher now so the magnitude of the potential mass migration from the vast tropics to the cooler north and south can barely be imagined. The looming mega-migrations from the tropical belts to North America, Europe, Russia and Australasia (Australia and New Zealand) will dominate the 21st century and shatter the current global “liberal” world order.

Europe will be most directly impacted by the coming tsunami of human migrations and I have written in detail why I think the geopolitical outcome will be that southern Europe will become part of Dar al-Islam. How events will pan out within northern Europe depends on whether the growing Muslim minorities integrate within the wider European society, governments successfully marginalise and crack down on the Islamic extremists and ultimately on the ability of the security forces to maintain order in the future.

Internal migrations within the EU, from the increasingly hot and troubled southern Europe to the cooler and safer north will also be a major challenge for the EU. Assuming that the British successfully leave the EU and regain control over their borders, they may be relieved to escape the potential liability of becoming the destination for Italians, Greeks and Spanish citizens when the millions of predominately Muslim refugees attempt to storm into Europe in the 2030’s.

One just has to watch the news to see that the oldest democracies in the world, the UK, America and France are facing government gridlock, political paralysis and riots on the streets at the moment. As our economies stagnate, growth slowly dies and our politicians desperately stumble from one crisis to another as we descent down the path of the Long Descent, popular frustration with democracy will grow. I expect to see the democratic club of nations to continue to shrink in the coming decades. A wildcard prediction for 2019 (30% probability) will be that the security forces of the French state will join the “yellow vests” movement and strike themselves, leading to civil unrest and chaos in the heart of Paris. Commentators will refer to it as the “French Spring” given the parallels with the Arab Spring.

The biggest geopolitical story is the long-term decline of the de facto American empire and why some kind of grand crisis is looming in the 2020’s. I have already reviewed John Greer’s excellent novel on how China will defeat America in a major clash in the mid-2020’s as well as a recent book on the impending fall of the American empire by the historian Alfred W. McCoy. To sum up, I expect that a major crisis will erupt at some point next decade that will herald the end of American dominance and the rise of the new Chinese-Russian axis in global geopolitics. As part of that long-term trend my forecast (70% probability) is that President Trump will successfully withdraw the majority of troops from Syria.

To summarise, I see 2019 as more of the same in terms of the big picture but longer term, the 2020’s will prove a major crisis for Americans in particular as they adjust to the end of their dominance over world affairs.

Looking further into the future, the key moment will be around 2030, as economic growth for the majority of the planet withers away and we enter into an era of economic contraction, population decline and a frightening new era of mega-migrations from the vast tropical region. The 2030’s will look and feel similar to the 1930’s, a dark and frightening decade with no clear light at the end of the tunnel.

My personal advice to those reading this article is to enjoy the relative stability of the current political and economic status quo as it will not last forever.