Al Jezeera

“…Where this could all lead is almost too grim to contemplate: debt defaults, soaring unemployment, mass impoverishment, famines and “existential” (as Ethiopian Prime Minister Abiy Ahmed has put it) damage to economies. Divides between the Global South and North, and indeed within individual societies in the Global South, could worsen as those who can afford to pay their way out of lockdowns – with testing, contract tracing, bio-surveillance and so on – pull ahead of those still deeply affected by the virus and its economic fallout.”

“Coronavirus hits global south”, New Statesman, Jeremy Cliffe

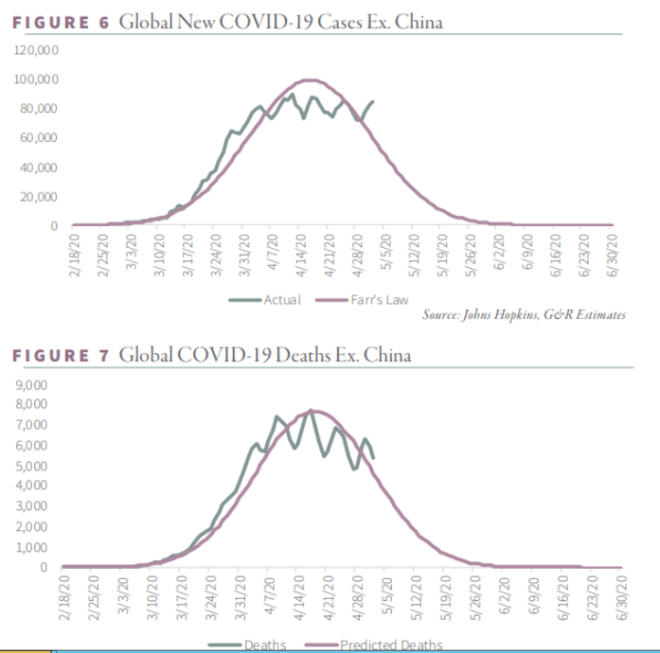

“We have been modelling both COVID-19 deaths and cases according to Farr’s Law ever since and the results have been fascinating. Thus far, both COVID-19 new confirmed cases and deaths have followed Farr’s Law curve perfectly, each with an R2 of 0.995.”

Goehring & Rozencwaig market commentary

In my last post I warned of the risk of social unrest as a social and economic consequence of the lockdown measures imposed by governments around the world.

The violent clashes with police in France’s suburbs and the less reported but widespread social unrest across the developing world during the month of April reflects the perilous economic state that many were plunged into by the lockdown.

For this post, I wish to discuss my thoughts on the likely endgame of this virus. My forecast, and it may surprise some of you, is that this virus has already peaked in the majority of countries and is now fading away.

Indeed, my specific forecast is that by June this year there will be very few confirmed new cases in the majority of the world. The pandemic will disappear as fast as it appeared on our planet.

The virus, so far at least, is tracking the models originally developed by Dr William Farr. G&R, an investment research firm, have been tracking the Covid-19 cases on Farr’s Law curve and have found that so far it fits perfectly (see above quote).

Goehring & Rozencwaig

Goehring & Rozencwaig

As you can see from the above graphs, it is looks likely that by the end of May the virus should have largely disappeared from the world.

A big question remains whether a second wave or secondary peak will come later on this year. The example widely credited is the Spanish Flu outbreak, where a far nastier second wave occurred later on which killed many more than the first wave. We have also seen second waves during the global flu pandemics during the 20th century.

It is important to note that many epidemics follow the bell-shaped curve of Farr’s Law with no second wave arriving later on. Certainly G&R, in their commentary, are sceptical of the notion that a terrifying second wave is inevitable in relation to our current pandemic. What I am reasonably confident in saying is if, and it remains an if, a second wave occurs later on this year, our governments and public health systems will be in a far stronger position to test, isolate and contain any renewed local outbreaks of Covid-19. Apps will be installed, armies of human trackers will be trained and the world, in general, should be much closer to the successful South Korean model of “test and isolate”.

A second wave of the virus, should it actually happen, will be most likely milder and far more successfully contained in comparison to the 1st wave. Indeed, I suspect the global response, when we wait in trepidation in Autumn for the dreaded second wave of cases to appear, will be a global “is that it?”.

For those who remain sceptical of the notion that we can avoid a second wave, the Danish chief epidemiologist has publicly stated that Denmark, which reopened society in mid-April and continues to see its infection rate plummet, will unlikely be hit by a second wave of Covid-19.

If the above is true, and we can speculate as much as we can on why this has occurred, it indicates a much stronger economic recovery in the second half of 2020 than some are forecasting. I anticipate that social distancing rules, maintained in some form of another for the majority of countries during the summer, will be progressively lifted during Q3/Q4 2020. Risk assets, including stock markets, will see an end of year rally driven by investor euphoria over the return to our post-Covid normal.

There will be economic aftershocks, severe in some countries and economic sectors, particularly in the developing world, global tourism and hospitality industries. The Global South will be badly hit by the economic hit and lockdown measures imposed and we will likely see further political and social turmoil in the months to come as hundreds of millions face severe food insecurity and shortages.

Even in the developed world, the pandemic has acted as an accelerator to existing trends already in the making. The movement to cloud based computing, collapse of well-known retail names, the neo Cold War between a rising China and declining America, rise oF online learning, working and shopping and the rejection of hyper-globalisation.

John Greer, in his recent post on the impact of Covid-19, wrote about how the lockdown has forced families to cook at home and re-learn traditional household economy skills that have withered away over the previous generation. The return of the household economy (where goods and services are made at home or bartered/gifted outside the intermediate economy) is a massive long-term trend which has barely started. I have written previously on why it is likely, given the pressures of the Limits to Growth megatrend, that we will see a long-term collapse of free market economies.

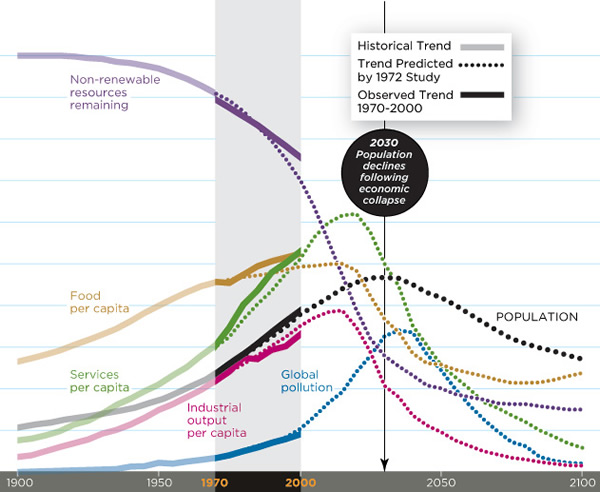

Longer term, I think historians and economists will treat the 2020 Great Lockdown as the trigger point for the longer-term reversal of decades of economic growth as forecast in the 1972 Limits to Growth business-as-usual modelling.

Forecasting Intelligence

As I explained, rather prophetically at the beginning of the year in my blog post here, the beginning of 2020 was the peak of industrial civilisation and we have now embarked on the Long Descent, for better or for worse.