Adobe

Apologies for the delay in posting, been a bit busy the last few months!

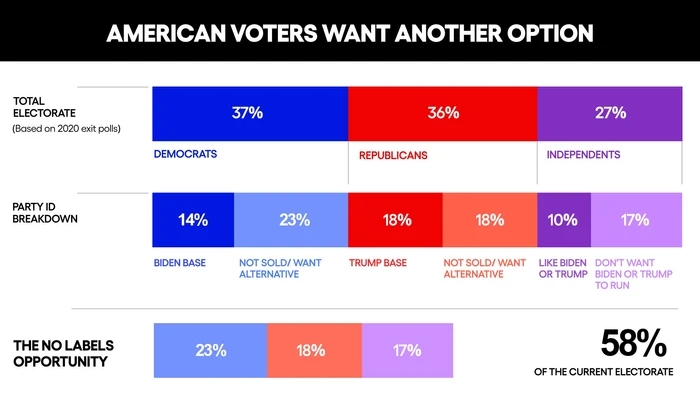

So, what has fundamentally changed since my last series of posts early this year and late last year? Well, for one thing it looks highly likely we are facing a re-run of the Biden versus Trump contest in November 2024 (assuming neither candidate is incapacitated or dies between now and then).

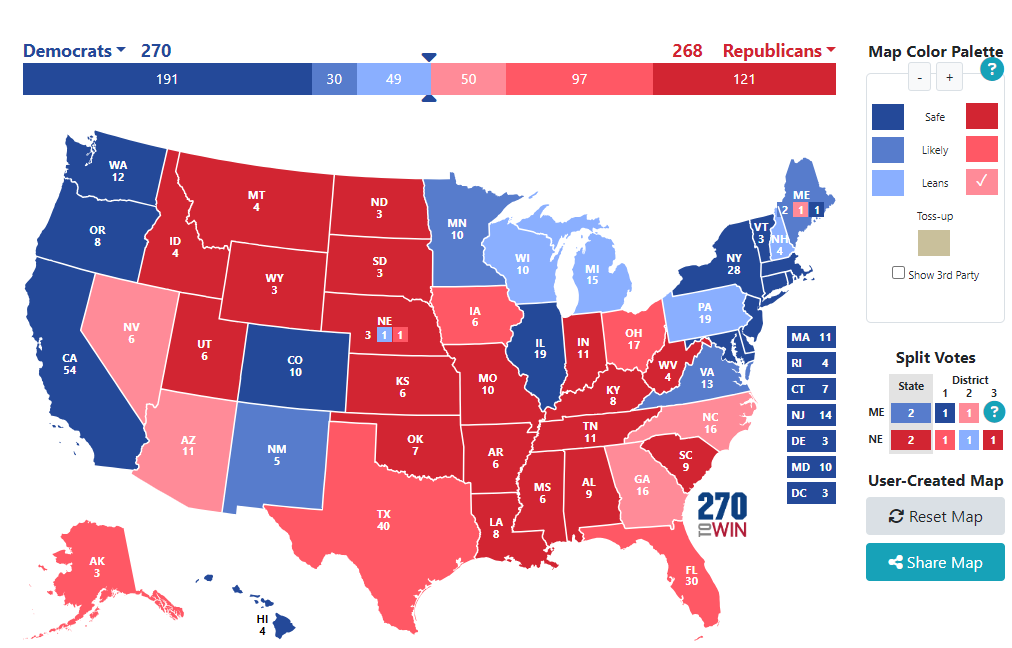

If one looks at the swing state polling, there is a clear and consistent trend that Trump is narrowly ahead in the majority of the states and this has been the case for months now. There is a plausible path for President Biden to win, through Michigan, Minnesota and Pennsylvania (which assumes he loses the rest of the swing states like Arizona, Georgia, Nevada etc).

Here is the map for the US electoral college geeks among you.

My own personal view remains, albeit with a low conviction ratio, that Trump is more likely than not to win this election but very narrowly. I wouldn’t be shocked or surprised if the above turns out to be the result on election day though.

Biden’s best pathway is through the mainly white Rust Belt states in the northeast given his declining numbers among non-white minorities that are trending towards the Republicans.

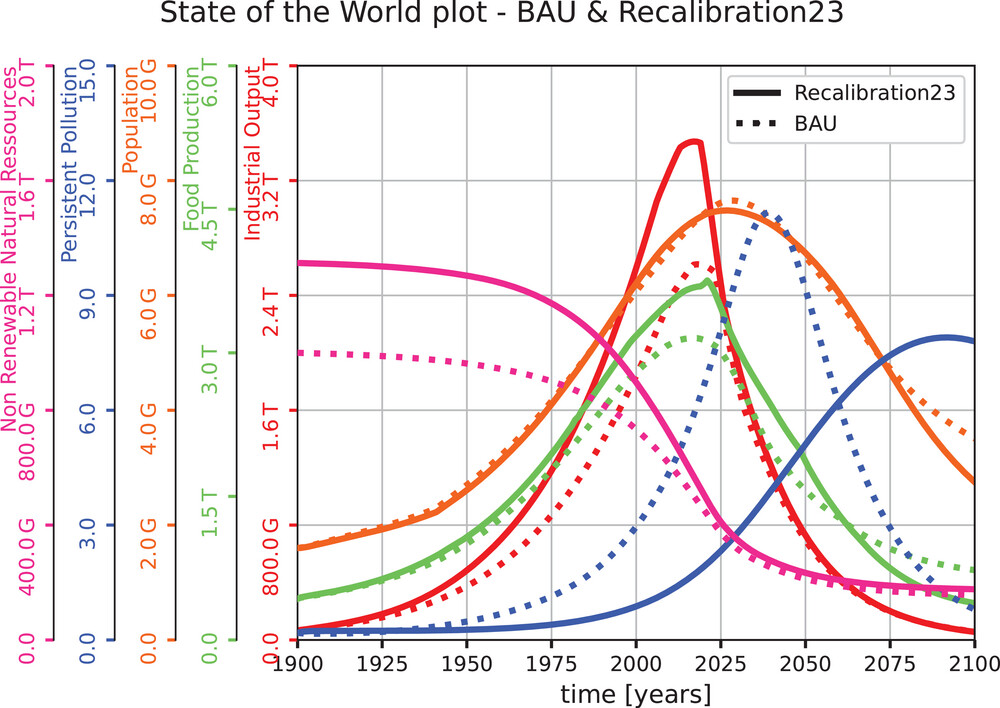

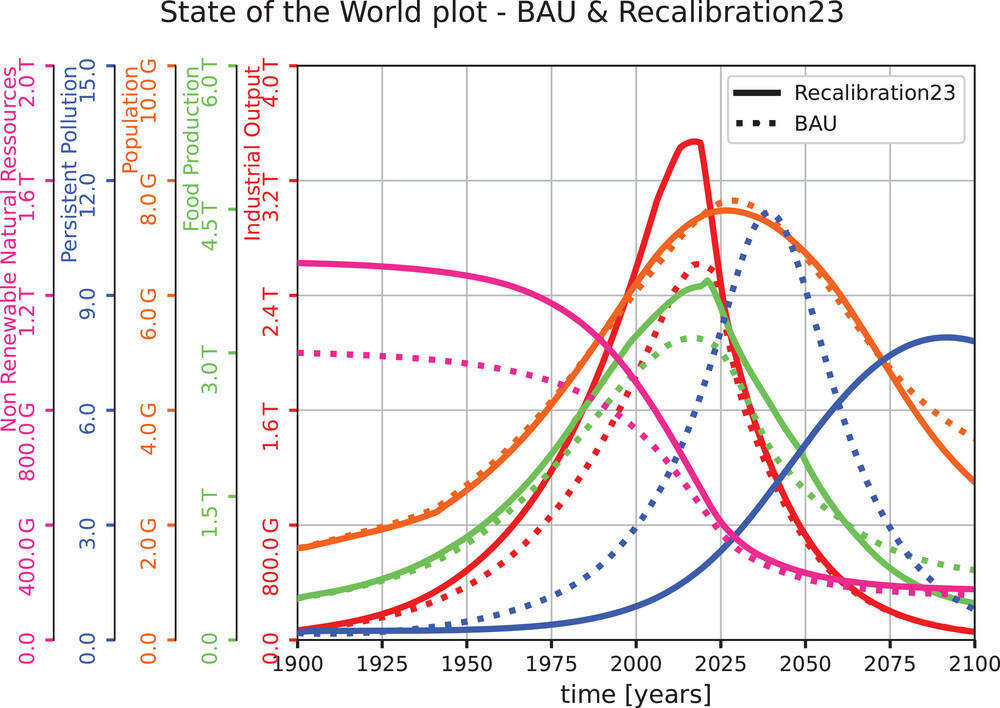

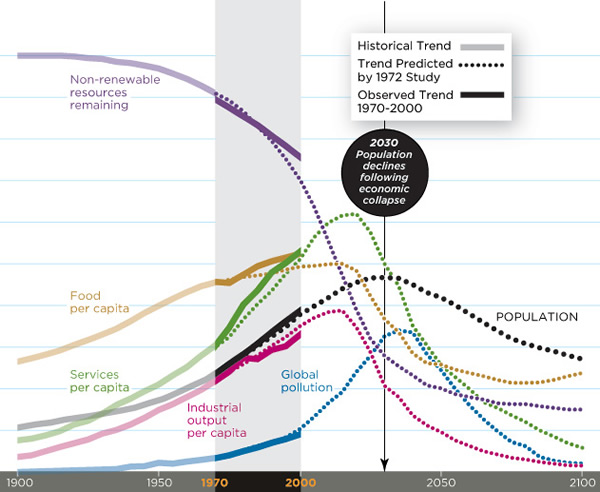

At a bigger scale, all the metrics do seem to suggest we are tracking the LTG BAU modelling on a macro scale. I discovered a very interesting article recently called Peak Everything which attempts to track what is likely to be an economic depression coming.

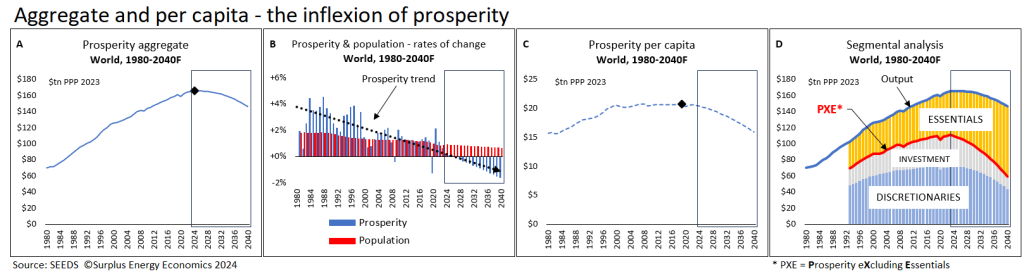

Here is one of their graphs, one I find most interesting:

It tries to capture the trajectory of the global economy as we face declining energy inputs and rising energy requirements to maintain energy supplies going forward.

What is clearly obvious is that 1) more and more economic activity will be essentials in nature and investment and discretionaries (e.g. nice to haves) will shrink from around now into 2040 and 2) at sometime around the mid 2020s, again around now, global prosperity will shift into contraction rather than growth (it appears to become clear around 2026/27 when we tip into economic contraction), until then we are basically stagnating (with certain bits of the globe still growing for a few more years).

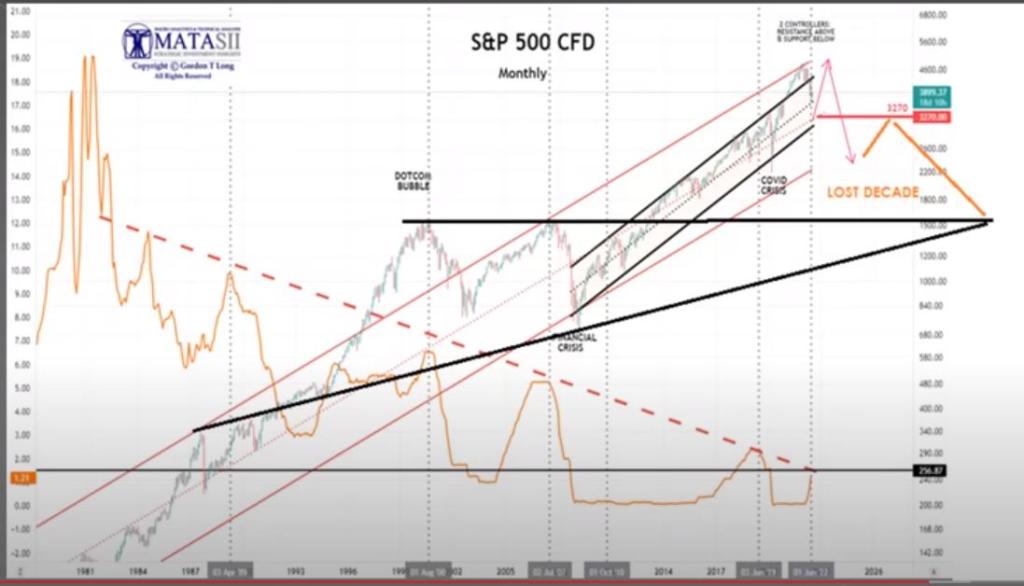

This also aligns with various sources I track in terms of the S&P 500 that suggest we are looking at a peak in the US equity index around 2026 at 6k or above. Whether it crashes after that, corrects and goes sideways until the late 2020s remains to be seen. Certainly looking at those charts its hard not to conclude a major financial and equities crash is looming, certainly past 2028 or so.

My personal strategy is to take profits over 2025/2026 in my equities, hold cash and be patient and wait for the inevitable crash in the markets to buy high quality dividend earning companies geared to the “essentials” economy. I’m thinking mining, energy, fertiliser, agricultural and consumer durables. After all, we will still consume energy, use copper, eat and produce food and require tractors, toothpaste and baby wipers in 20 years (even if we can’t afford fancy smartphones, new cars, foreign holidays, new clothes, expensive aftershave and the latest tech gadgets etc).

That is what the blog, which I do recommend reading in full, here, covers in depth.

Population trends, specifically the looming peak in global population is also beautifully captured by one of John Greer’s recent essays, here. To cut a long story short, with a contracting population you will see a contracting economy. There will be little point investing (outside niche areas), businesses will struggle to make a profit and anyone who owns assets should expect the mean to go lower as less and less people are around to use or consume anything.

Peter Zeihan has also discussed the dire implications of this for our current system in depth as well. The long and short of it is welfare systems, and pension systems in particular, are unlikely to survive these shocks. What is likely to happen is a political crisis, triggered by a fiscal/debt crisis triggered in term by the end of growth and various attempts to try and stabilise the system. This will be a mix of rampant money printing, cutting of benefits to working age people and in the worst case scenario a collapse of governments.

The key point to remember is to rely less on governments and corporations going forward. DIY is the future as Greer writes well in his latest post online. One example of rising costs is insurance, something Ian Welsh has commented on his recent post here, as availability is already starting to shrink for those places most exposed to fires and hurricanes.

“As government fails, we will be pushed back on what we can do for ourselves, and for that to work we’ll have to be realistic: “what can our group actually do?” Can we source medicines? Can we rebuild?“. This is our future, we will have to become more self-reliant, whether we like it or not.

So my macro outlook remains the same, these forces are building up like a earthquake, the signals are already flashing red, and are likely to explode in the late 2020s/early 2030s in a systemic political, financial and energetic crisis.

I haven’t discussed this before, but I have maintained a private “model” of where the Ukraine war is heading for a while now. We are tracking a WW2 model, with 2022 being Russia’s 1941 (a disaster), 2023 being 1942 (not good but Stalingrad proving a turning point), with 2024 being 1943 when Russia made major progress in winning the war and gaining territory, and 2025/26 being the collapse of Ukraine and surrender.

The loss of Bakhmut to the Russians in 2023 is equivalent to Stalingrad and the more recent loss of the fortress of Avdiivek could potentially be similar to the Battle of Kiev in 1943, after which the Germans lost their strategic offensive capacity. What this suggests is a collapse of the Ukrainian lines at some point between this year and 2026, or at least starting this Summer when the Russians are likely to launch their massive offensive.

The defeat of Ukraine would not just be a disaster for Ukrainians but also a humiliation for NATO and the Western powers. It will cause huge tensions within the EU and likely accelerate the withdrawal of the Americans back to their continental heartland.

To summarise, we are still in the early stages of a collapse of the current globalised geopolitical and economic order and whatever replaces it will be regional and local in nature as globalised supply chains unravel in the coming decades.

Our world will become smaller, more frugal and closer to what our parents and grandparents lived. Its not the end of the world but the expectations gap between the future we were promised and what we are likely to get is huge, particularly in the developed world.

Best to buy the popcorn and enjoy the ride folks.