http://www.pinterest.com.au

“The Gefira team expects that the global economy will come crashing down as the oil price starts soaring again in the coming years.”

GEFIRA newsletter no 19 (subscription only service)

“True believers in the religion of progress are promoting these claims at the top of their lungs to keep from having to admit just how fast the decline is becoming. It’s quite possible that self-driving cars of a sort will come into use, but the death toll is likely to be even higher than the toll from bad human driving. As for the others, people have been insisting that automation will put everyone out of work any day now since before I was born, and artificial intelligence has been a will-o’-the-wisp hanging in the notional future since before that. Expect them shortly after cheap nuclear fusion comes on line and you begin commuting to work via jetpack.”

John Michael Greer (Ecosophia)

Reader, you may be wondering what the picture represents.

It is an automated robot, powered by air or water that moves its arm, pours liquid into a cup for the services of its human owner. The catch is that the human owner was called Philon of Byzantium and was made in circa 250 BC.

For those readers who think that incredible technological disruptions like automated robots are a new phenomenon, think again. They were already in existence prior to the birth of Jesus Christ.

I am not here to belittle technological developments, far from it, but it is a useful reminder that exciting and quasi-miraculous technological devices have been around for thousands of years in human history. Yet, just as the robot invented by Philon didn’t stop sophisticated Ancient Greece eventually falling into a Dark Ages, the modern-day equivalent will not prevent the disintegration of our industrial civilisation into a future deindustrial Dark Ages.

And that is the challenge of this post. I admire technology and have written a blog post on the potential technological and investment opportunities of the emerging world of crypto-currencies and the blockchain technology that underlies it. I attend tech events to keep up with the latest advances in Artificial Intelligence (AI), robotics and automation. There are exciting developments in this space, with real commercial potential and room for significant technological disruption in the coming decade.

Yet, as long-time readers of this blog can attest, the dirty physical reality is important as well. Without sufficient flows of oil, the lights don’t go on, the cars don’t move and without electricity that computer in your room is a useless piece of junk. The bitcoin which is held in the ether might as well not exist without fossil fuels which is still the life blood of our industrial civilisation.

The experts at the Financial Sense website recently did a recent fascinating podcast on the looming supply crunch in the global oil markets. Existing conventional oil reserves are depleting at 6% annually, investment by the major oil companies has collapsed since the fall in oil prices after 2014 and despite the rise in American shale production, a major oil supply crisis will come within the next 2 to 3 years.

Rudyard Kipling, the British Empire poet, in his Barrack-room ballads, in 1892, wrote that never the twain shall meet in reference to the gulf between the the British and the inhabitants of the Indian subcontinent. When reading the online world of technology and what one could call the Limits to Growth sub-culture of sustainability, climate change and resource depletion, the same spirit arises. There is a vast gulf between the two worlds and my job is to attempt to bridge the divide.

With reference to my 2016 Limits to Growth orientated post, “winter is coming”, I will attempt to sketch out how I see the next 12 years of economic history develop with a particular focus on the looming waves of technological changes.

The financial data is indicating that some kind of technical or mild recession may hit the developed world in between 2019 and 2020 but right now, it doesn’t look like a re-run of the 2008/2009 financial meltdown that nearly destroyed the global banking system. I imagine that in the event of an economic recession, however mild, the printing presses of the central banks will flood the markets with billions of new euro’s, dollars, yen and sterling. This will postpone any relapse into recession but at the cost of increasing the inflationary pressures within the global economy.

One of my forecasts at the beginning of 2018 was that oil would hit $80 dollars which happened on 17th May 2018 on the back of tightening supply and worsening geopolitical tensions in the Middle East. As Ambrose Evans Pritchard notes in the Telegraph, leading investment firms are starting to predict of an oil spike to $150, which would be shattering to an oil starved Europe and trigger a major global economic crisis. The GEFIRA forecasting team are similarly predicting an oil supply shock around the year 2020 as referenced in the quote above.

The most likely outcome, although there are many variables at play, is that worsening trade relations between a Trump America, the European Union and China, a steadily rising oil price and the coming to the end of the economic recovery will precipitate a major systemic crisis by the early 2020’s. This will be a perfect storm, with oil and other commodity prices spiking, leading to massive demand destruction as the world plunges into another serious recession.

There will be an inflationary run-up to this crisis and we will likely see a bull market for owners of commodities, including oil, gold, silver and crypto-currencies. Of course, just as in 2009, the subsequent collapse will be spectacular with commodity and other “risk-on” assets likely to collapse. The political, geopolitical and social ramifications will be profound as well. A further round of pauperisation of the middle classes of the developed world will lead to a further wave of support for populist parties of both the nationalist right and the alt-left, just as we are currently seeing in Italy.

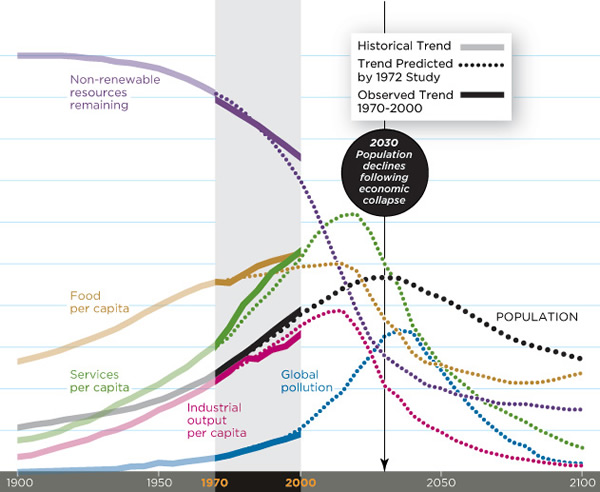

I would encourage my readers to view the following graph. The Limits to Growth business-as-usual (BAU) model is broadly in line with real world data and one can see that, even factoring in that the real-world data is marginally more positive then the model, by the early 2020’s the global economy will face the start of a protracted collapse.

So where does this leave technology? Certainly, for the next 5 years, the hundreds of billions pumped into AI, robotics and automation will yield some promising and exciting commercial transformations in banking, trade and industry.

Within the financial services industry, you will likely see a number of interesting innovations, including the emergence of bank chatbots, to deal with simple requests from the client, the continued shift from physical to digital through apps for a range of services and products and the mainstreaming of crypto-currencies and blockchain as a new asset class to be invested in.

Blockchain has significant disruptive potential and the insurance, trade sector and real estate industry are prime examples of where the distributed ledger system will be more accurate, transparent and reliable to the old ways of doing business. The following graph captures the likely disruptive wave of blockchain over the course of the next decade.

http://www.investinghaven.com

The rise of tokens or cryptos could open up entirely new spaces to financialization. Fancy owning a fraction of a token of a Picasso painting? With a Picasso token you could do just such a thing within a decade. Tokens and the underlying blockchain technology will not be a technological savior but it will improve efficiencies in traditional industries, open up a new frontier for finance and will help new banks challenge the old banking dinosaurs.

Robotics have been around a while now. A modern-day car factory is filled with robotics efficiently creating car parts where there used to be humans doing the hard labour. Japan, at the forefront of the demographic winter facing the West, has invested a huge amount into robotics but with little to show for it. Despite a few gimmicks, cleaners, care assistants and primary school teachers have not been replaced by robotics yet.

The cost, complexity and severe limitations of the most advanced AI systems put huge challenges in extending the robotics/AI revolution outside the car factory plant. Until Japan succeeds, my assessment is that robotics will not prove a major disruptor before the Limits to Growth mega-trend kicks in by the end of the next decade.

There has been much chatter about electric cars in the media over the last few years. Electric cars are powered by the grid rather than oil. The grid, of course, is not powered by the air, but by either renewable’s, nuclear power or fossil fuels like oil, gas and coal. Electric cars, if adopted on a mass scale, would significantly reduce oil demand which would clearly help with the coming oil supply crunch. However, for this to occur, the pressures on the power grid will grow, trillions will need to be invested on an electric infrastructure and the global car fleet replaced.

This is doable for emerging countries like China and India, who have the opportunity when building new cities to construct a new electric based infrastructure but given the huge costs involved, electric cars will remain a niche sector in the advanced world. Overall, despite the shift to electric in China and other emerging market economies, electric cars, given the reasons listed, will not act as a game-changing disruptor in the coming years.

As for self-driving cars, even those involved in the industry consider the regulatory, technological and ethical issues at stake make it nigh impossible to happen on anything more then a few pilot cases. Like John Greer, I am highly skeptical of autonomous cars and consider that if it happens at all, it will be restricted to a few fixed lanes within cities or long-distance motorways.

American shale oil, otherwise known as “frackers” have had a tremendous decade boosting American oil production. I concur with Nafeez Ahmed analysis, which I reviewed here, that “… American unconventional oil and gas shale’s will likely peak around 2025”. Given the vast sums of capital flooding into the industry, the technological genius of the frackers and the commitment of American political leadership to the goal of energy independence, production is likely to go up over the next few years despite the severe depletion rates (compared to conventional oil and gas reserves).

In the grand scheme of things however, the frackers have only postponed the inevitable for over a decade.

If there is a theme when reviewing the technological disruptors facing us, it is that those technological innovations that will require billions, if not trillions, of investment in the “real world”, are unlikely to pass. This includes robotics, electric cars and for that matter, flying cars.

Apps based disruptors, like downloadable wallets on your smartphone, crypto-currencies on the ether and the shift to digital based activity like buying online, will continue to transform traditional industries. Apps are a good example of an innovation that doesn’t require vast expenditures on new infrastructure and are given the financial and energy restraints facing our world, it is these technological waves that will cause most havoc over the next decade.

The biggest wave of them all is the looming Limits to Growth mega-trend, the likely peaking of key economic metrics within the next decade and the end of economic growth itself. At some point, probably by the 2030’s, these constraints, with contracting fossil fuel supplies to the world’s industrial economies, will be a hammer blow to the tech industry. Power cuts, disruption to global supply chains, worsening climate change and growing global instability will shatter the assumptions underlying our existing political-economic system. Faith in economic growth, cheap and reliable energy and uninterrupted power supply will fade away.

Overall, my assessment is that significant technological disruption will continue to change existing industries, in particular within finance, retail, real estate and others ripe for disruption by the insurgents within the blockchain/digital space. However, none of this look likely to change our trajectory, as forecast by the Limits to Growth BAU model, of growing crises starting from around 2020 and accelerating beyond 2030 as the world population peaks.

…………………………………………………………………………………………………………………………………………………….

Existing readers will note that the President Trump did, as I forecast, utter a clear threat to his fellow NATO member leaders, to “go it alone” if they did not increase their defense spending.

As Reuters reports, “U.S. President Donald Trump told NATO allies in a closed-door meeting on Thursday that governments needed to raise spending to 2 percent of economic output by January next year or the United States would go its own way”.

We will see whether Trump does go ahead with his threats early next year but the trend is clear. American support and commitment to their European NATO allies is waning and the broader implications is worthy of a FI post in the future.