https://3.bp.blogspot.com

“… after 2030, both the Euro-Atlantic core, as well as the fast-rising Indo-Chinese periphery, will begin to experience their own symptoms of systematic state-failure”.

Nafeez Mosaddeq Ahmed

This book is a tour de force and a must read for anybody who is interested in the future fate of our industrial civilization.

Stylistically, Nafeez Mosaddeq Ahmed (“Ahmed”) is very different to that other great chronicler of our declining civilization, John Michael Greer (“Greer”), who is an easier read for the layman reader. I have reviewed two books by John Michael Greer, one a near future thriller which posits a rising China defeating America in the 2020’s and a non-fictional book on the impending collapse of the American empire. Both are superb and at times deeply troubling reading experiences.

Ahmed’s book is drier, academic and references a huge array of empirical and scientific studies to back his conclusion that our industrial civilization is heading towards severe trouble within the next 20 years. What it lacks in Greerian narrative and rhetorical flourish is made up by the use of data and scientific research to force the reader to acknowledge that the resource and ecological limits are pressing ever harder on our globalised economic order.

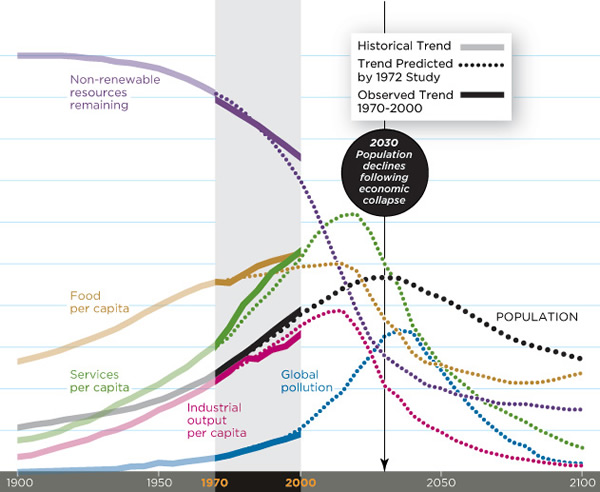

What is striking about Ahmed’s book is that his forecasts for key regions, including Europe, the Middle East, Asia and North America and when their systematic crisis will likely arrive are remarkably close to the 1972 Limits to Growth business as usual modelling shown below.

https://www.commondreams.org

I have discussed this prescient report before in my post “winter is coming” which you can read here.

So what did Ahmed forecast in his book? Here are the key points;

The world is seeing a “new normal” of extreme weather events, summer heat waves, wildfires, droughts, floods and extreme rainfall which is increasingly common throughout the world. The climate system is being fundamentally transformed, a “climate departure”, which means that within the next decade in the tropics (e.g. encompassing parts of the Middle East, Asia, Central Asia, South Asia and Africa) this will become the new normal, rendering the vast region uninhabitable by 2030-2040, due to prolonged heat waves and dust-storms.

The rapidly changing climate in this vast tropical zone will imperil the lives of up to 500 million people and will lead to mega-migrations into Europe. The political and demographic implications of this enormous wave of humanity attempting to enter Europe I have explored in a post earlier this year which you can read here.

Saudi Arabia, a pivotal global oil supplier, has seen its oil exports decline by 1.4% every year between 2005 and 2015. According to the net export model, Saudi Arabia net oil exports have been forecast to decline to zero by 2030. The Gulf States will face a systematic crisis within the next decade as the money runs out to keep their populace happy.

Total net oil exports to Europe by the former Soviet Union countries including Russia, Azerbaijan and Kazakhstan will decline to virtually zero by 2030 as production declines and China captures a growing share of oil production for its own requirements.

The south-western region of North America is facing severe water scarcity and climatic disruption, which could lead to Lake Mead running out of water by 2021. Lake Mead is the main water supply for the mega-city of Los Angeles and 90% of southern Nevada. The looming crisis is so great that in the medium term it threatens the viability of Californian agriculture and a substantial chunk of the global foodstuff exports which will lead to global food price rises.

American unconventional oil and gas shale’s will likely peak around 2025 which will ensure that the United States is relatively energy self-sufficient compared to Europe in the short-term. After that America will become increasingly dependent on oil imports by 2030 when these supplies will be drying up around the world.

The impending peaks in oil production and net export decline by key producers will lead to another global oil supply shock by 2020, something that I have warned recently in my review of crypto-currencies.

The core regions of our industrial civilization, Europe and North America (“Euro-Atlantic core”), will sustain the neo-liberal status quo by continued debt-money quantitative easing policies. However, after 2030 both the Euro-Atlantic core and the rising giants, India and China, will experience their own symptoms of systematic state failure.

Greer has recently commented on his blog that he expects to see another economic shock at some point in the foreseeable future which China will emerge, after the hit, as the dominant hegemonic power on the world stage at some point next decade, supplanting the United States. This strikes me as eminently plausible given the above trends outlined in Nafeez’s book.

Whilst Nafeez’s forecasts and dates are hypothetical and may be proven wrong, the overwhelming conclusion from reading this book is that readers would be foolish to ignore the rising alert signs emanating from different corners of the world. When visiting Granada last month, the local people mentioned the drought and the extreme heat wave in the summer of 2017, when temperatures hit 47 degrees in the shade! If this “abnormal” climate continues, parts of southern Spain could become uninhabitable within a decade. Indeed, the tour guides mentioned that the locals fled the city during the summer months to escape the extreme heat as it was so intense.

To conclude, if you are interested in learning more about the systematic challenges facing the world in the coming generation, Nafeez’s book is required reading.