CNN

Apologies for the long delay in posting but life, and to a certain extent a rut in creativity, has got in the way recently.

Over the course of the last 6 years, I have extensively covered many themes on this blog, fine tuning and developing my thinking on how things will develop in the years and decades ahead.

For those who are new or need a reminder, in very short form, my case is we, at a macro global level, is tracking the Limits to Growth Business As Usual (“LTG BAU”) model developed in the 1970s. We peaked in 2019 and are now in a multi-generational Long Descent.

Specifically, this decade is when the global economy falls apart, global population levels peak by the end of the decade and rolls over, and per capita metrics decline rapidly. Its already happening. In the developing world hundreds of millions have fallen out of an emerging middle-class lifestyle, many more are facing malnutrition on the back of soaring energy and food costs (they are really the same) and even in the more insulated wealthy West, metrics are worsening.

My essential thesis is we peaked, and whilst certain countries and regions will face different decline dynamics at different times over the next decade, the overall global landscape is of contraction not growth. Energy is at the core of our problem and no technological solution is going to save us or return us to a pre-2020 world. That doesn’t mean we can’t mitigate, adapt and conserve some of our energy rich lifestyle in the years ahead, but its going to be a huge challenge.

I stumbled across the following YouTube video recently, the slides of which I captured. It neatly captures the themes I’ve been blogging about for years and the timeframe looks plausible and aligned with what other sources I use see coming.

What is also becoming increasingly clear, based on the “best in breed” thinkers I follow (with a good forecasting track record) is how much of a rollercoaster the 2020’s is going to be:

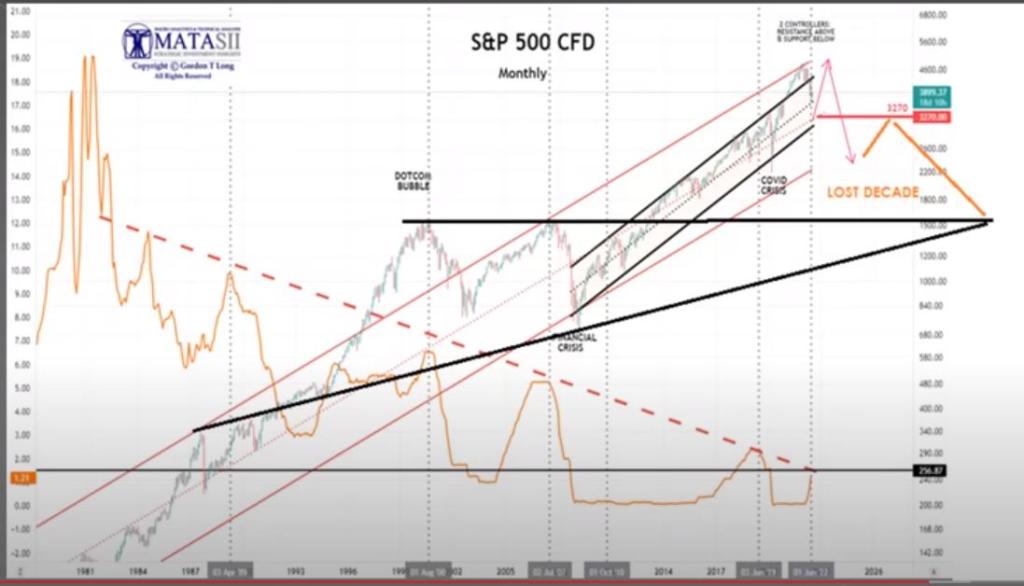

- 2023 is a deflationary moment, a lull, before the next big wave of inflation hits. Right now equity markets are soaring, inflation is falling (and is likely to fall much more this year). That’s the good news folks! Enjoy the bear market rally whilst it lasts.

- The bad news is, enjoy this moment, it won’t last long. 2024 is looking increasingly dire, a major correction/crash in global markets, an incredibly tight oil market and the possibility of exploding energy prices triggering further economic and financial turmoil. At the same time, ERORI will carry on skyrocketing higher as the energy inputs required to extract energy gets worse.

- 2025 is likely to be the year inflation roars back, this time double digits and worse than 2022. That is bad news for nearly everyone and puts further pressures on a global economy. The only winners in a turbo-inflationary return will be those sectors that do well (e.g. gold and silver miners, mining companies and to a certain extent energy stocks). We are also looking at increasingly dire food insecurity for the developing world that will worsen geopolitical risks (the wildcard this decade)

- The 2025-2029 period is looking to be a further cracking up of the global economy, de-globalisation and flaring up of geopolitical risks across the world.

- Late 2020s is the likely time the modest post-2025 recovery in global markets comes to the end. A massive market crash is looming, probably the market waking up to the fact the global economy is unravelling and pricing in a post-global economic world. Its going to be brutal and most people will see their wealth evaporate in the process. If you want to get a reasonably accurate sense of what that type of world will be, read Peter Zeihan latest book and John Greer’s peak oil books.

That’s the big picture folks. Better get ready and enjoy the perks of a globalised economy whilst it still lasts (think global mass tourism. Its unlikely to survive much beyond 2030)…

What about 2023? Well, there are a few things I am tracking:

- Excess deaths remain elevated across countries that used the mRNA vaccines. High levels of cancers, heart attacks and other nasty side effects that are correlated to the vaccines are also happening if largely ignored by the authorities. I expect that trend to continue (along with a modest but very real impact on long-term fertility) but this isn’t Armageddon, society will carry on but bear the costs for years to come.

- The war in Ukraine is very much a war of attrition. At some point one side will run out of ammo and be unable to carry on the fight. Reports in the media now suggest NATO is really struggling and will not be able to carry on arming Ukraine to the extent we managed in 2022. If Russia does succeed in breaking Ukrainian resistance over the next 2 years or so, that will be a huge geopolitical moment for NATO.

- A degrading infrastructure, in particular the grids, remains a major concern. Europe managed to avoid the blackouts you regularly see in places like South Africa (and even California) but there is no guarantee that next winter will be so accommodating. Building up resilience and self-sufficiency in your personal life remains good advice.

- Demographic challenges are getting worse. The boomers are retiring, there aren’t enough young people to fund public pension schemes across the developed world so at some point the benefits need to get slashed. Its going to become a serious issue, certainly in the 2nd half of this decade but a few countries are already on the brink.

That’s it for now folks. Enjoy life because we only live life once!