Hi all,

Happy New Year! I hope you all had a good Christmas and New Year break with your loved ones.

Well, in the end, whilst I was a bit cautious in my blogging my gut call that Trump would win the election was proven correct with Trump winning 306 EC votes, something I was privately forecasting to key friends a few weeks before Election Day but didn’t quite have the conviction to forecast on this blog. Lesson learnt is to be a bit more confident in my predictions but the key takeaway is I predicted Trump would likely win and also likely win the popular vote (something very few were predicting prior to the election, including the betting markets).

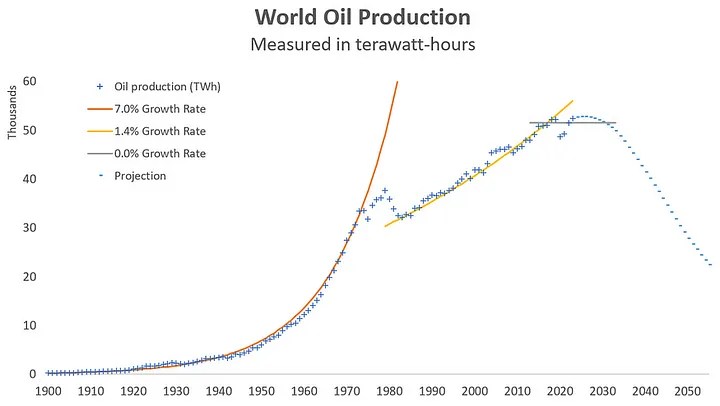

From a macro perspective, I don’t see 2025 to be that different from previous years. We are on a bumpy plateau of energy production globally with things bumping along until the end of the decade, even though the energy required to generate the newer energies continues to rise.

“BeardTree, granted. The question is purely how long they can keep going before hard physical limits come into play. What’s happened so far is that increasingly energy-poor grades of liquid fuels have been brought into the mix, so that notional production stays high but the net energy (energy yield minus energy cost of production) drops steadily. As long as they can keep playing that game, we can expect slow erosion of lifestyles rather than sudden discontinuities (from that cause, at least).”

As John Greer notes above in his recent blog Q & A we don’t know long they can carry on this playing this game. Probably for a few years to come. One of the biggest sources of energy, US shale has probably peaked and is on its own plateau for the next few years before it starts to fall around 2028/2029. So, my best guess, is 2030 or around that year, when that game comes to an end and we get the “sudden discontinuities”.

Those are likely to include serious economic and political crises, including market crashes and a globalised banking crisis for the history books. If major economies have tipped or are tipping into economic contraction markets will at some stage price that into bond, equity and other asset markets. That will cause havoc for banks that lend credit and hold government and corporate bonds on their books (among many other assets).

My base case remains that this crisis will hit, certainly the United States, around 2029 but its possible it starts to impact other countries (hint, Germany and other stagnating European countries) earlier in the decade.

Either way, my personal message remains the same, Get out of debt, be sensible in spending, develop skills and alternative income streams, enjoy life and the opportunities that currently exist in our industrialised civilisation (like internet shopping, relatively cheap global travel etc).

From a geopolitical perspective, I expect at some point in 2025 some kind of deal between Ukraine, Russia and the West that ends the war. I’m sure both sides will declare victory but if the Russians carry on their military progress it will be a de facto win for the Russians.

Syria, despite the best hopes of some in the West, is likely to descend into anarchy and sectarian war as the new Islamist government shows its true colours.

Iran, having lost its external empire of proxies and terrorists in 2024, looks very vulnerable to an internal revolution. I don’t know if it will but I wouldn’t be shocked if some kind of crisis – maybe severe water shortages or the grid going down – triggers protests that lead to the overthrow of the Mullahs.

I don’t think we will see any clash in East Asia – at least in 2025 – over Taiwan. The election of President Trump provides the opportunity for a Grand Bargain between the United States and China. Whether a war or near-war happens later on this decade remains to be seen but Trump is less likely to trigger a war over Taiwan than any other US political leader.

Europe will continue to economically stagnate, hobbled by expensive energy, unsustainable welfare systems and a political-regulatory system that crushes the private sector. I don’t see any elections within Europe that really changes that dynamic for the foreseeable future. My sense is 2029/2030 is when the revolutionary tides comes for the failing European political class and we see populist and insurgents come to power in western Europe. A good case on why Europe will fall is made by this author here.

What happens in America, specifically whether Musk and his allies can really transform the US federal government into a leaner and more productive apparatus will be fascinating to watch. DOGE has the potential to transform the West’s politics and is already exerting pressure on a failing Europe to start de-regulating. It won’t happen of course, at least for a few years, but one can see the winds of change howling across the Atlantic.

Woke politics has peaked and is now on the decline. Once the higher education system – which is slowly going bankrupt anyway – starts to crumble the ideological centre of wokeness will go with it. That’s a good thing and will restore sanity to our politics.

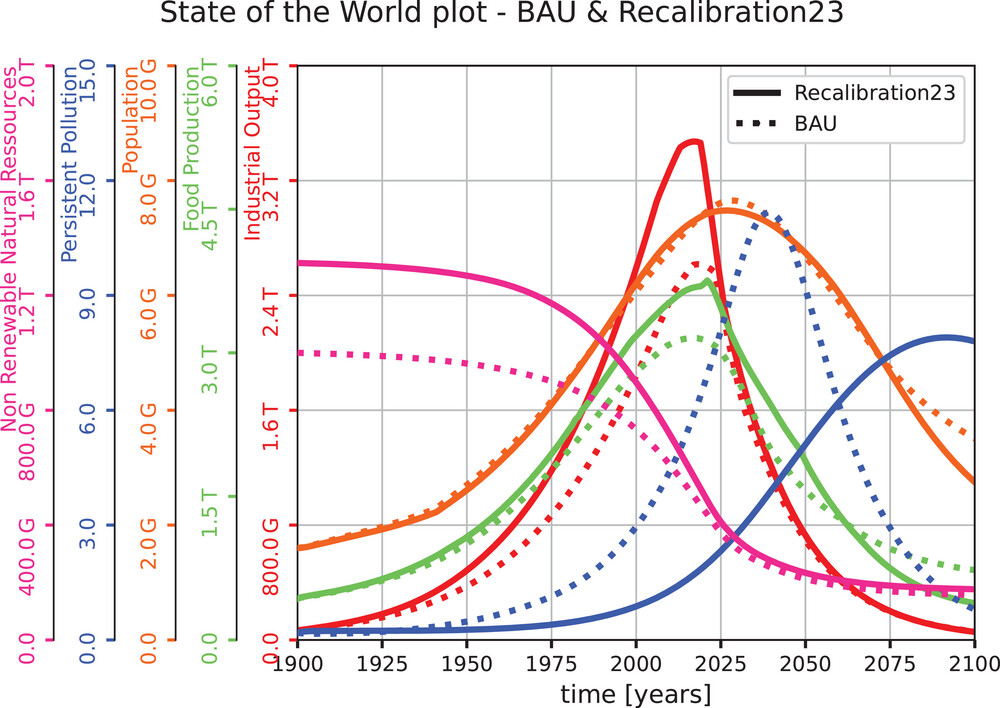

A few analysts I follow are predicting that Artificial Intelligence (AI) will save us in the 2030s and beyond. Supposedly AI will help unleash a new era of cheap energy powered by fusion and SMR’s (small modular reactors), our economies will become vastly more productive and so on. I’m not saying that AI doesn’t have potential and won’t make major advances in certain areas (like biotech, financial services and defence) but I can’t help but feel sceptical on a number of grounds – the energy cost of the data centres – the issues around hallucinations and the usual hype cycle we see in AI going back to the 20th century. So for me, whilst the jury is out, I’m on the sceptical side that AI will, at best give us a few more years, maybe, but it doesn’t fundamentally change the LTG BAU model I’ve been tracking since the early 2000s.

So, on that cheerful note, have a good year!