Screencrush

“Global population has to contract — 7 billion is way above this planet’s permanent carrying capacity — and yes, that’s going to involve the unravelling of the entire structure of growth-based economics. That’s standard in the late stages of a civilization, by the way — it’s why market economies give way to non-market economic arrangements as things unravel.”

John Michael Greer

“Again, the growth in potential consumption among the far poorer populations in no way offsets the declining potential of consumption among the declining wealthier populations…without ZIRP (or more likely NIRP) and debt of gargantuan proportions.”

Econimica – “Global Endgame looms – soaring debt smashes shrinking populations”

“Emperors came to believe that the army was the sole source of power and they concentrated their efforts on sustaining the army at all cost. As the private wealth of the Empire was gradually confiscated or taxed away, driven away or hidden, economic growth slowed to a virtual standstill.

With the collapse of the money economy (3rd century AD), the normal system of taxation also broke down. This forced the state to directly appropriate whatever resources it needed wherever they could be found. Food and cattle, for example, were requisitioned directly from farmers.”

Cato Institute – “How excessive government killed ancient Rome”

Before I discuss how our market based economic system will unravel this century with the end of economic growth, I hope some of my readership were able to take advantage of my political betting tip on the Tory leadership election.

Those of you who followed my recommendation in betting between the 60 to 79% victory margins on Prime Minister Boris Johnson would have received a guaranteed profit (if they had betted equal amount on both victory margins). To paraphrase the new British prime minister, a case of having your cake and eating it!

Those of you who placed a short position on sterling, following my Brexit post on 26th May, would be enjoying a decent return now that GBP/USD has collapsed from 1.27 to 1.22. However, going into a sterling short at this point is probably too late given that in the event of a no-deal/hard Brexit (not a given!) sterling is likely to fall to 1.15. The risks of an unexpected bounce in sterling should the UK avoid a hard Brexit makes this an unsuitable trade to recommend from a risk versus reward perspective.

I will continue to look for opportunities with the appropriate risk versus reward ratio and will flag them when they come up.

Making money has proven a relatively easy thing to do over the last century because of economic growth. As a general rule, economies across the world have grown during most years so the typical business or investor has operated in a growing rather than shrinking economic environment.

We take this for granted but it is, historically, speaking, an exceptional period in human history. Until the discovery of fossil fuels economic growth was at best patchy and limited.

Now that we are in the long twilight era of fossil fuels it’s not surprising that global growth rates are declining throughout the world and will, at some point, flip over into outright economic contraction. I recently discussed this issue in my post “Economic Winter and the coming end of globalisation” which is worth re-reading again. In my post I quote John Greer, one of the few writers who have given this matter genuine reflection, who writes that “…timing of the turn into contraction is complex, not least because it’ll be papered over by the manipulation of abstractions for a good long while. I expect it to happen one country or region at a time, with some maintaining growth while others begin to contract, but the tipping points are to my mind likely to cluster around 2030.”

I also concur with that time-frame, taking into account the broadly accurate Limits to Growth modelling which pinpoints a permanent global economic contraction around 2030.

As John Greer notes in the quote at the top of the blog post, this is not the first time a market based economy unravels in the later stages of a civilization’s rise and fall. In fact, it has happened repeatedly throughout human history.

The history of the Roman Empire can give us clues to how the shift from market economies to non-market economic arrangements occurs. Reading the CATO Journal article on the fall of the Roman Empire was a disturbing experience for me. As somebody who works in financial services and follows political and economic news closely, much of the events of those ancient times feel oddly contemporary.

For example, the financial crisis in 33 .D. was caused by a severe shortage of money. The response by the Roman government was for the state make “large loans at zero interest in order to provide liquidity”. That sounds remarkably similar to the quantitative easing measures introduced by the global central banks to provide liquidity after the 2008/9 financial crisis!

The debasement of the Roman coinage, the gold aureus and the silver denarius, by repeated Roman emperors tracks the long-term decline in the real value of fiat currencies ever since the end of the Gold Standard. Under the generally well regarded reign of Marcus Aurelius (161-180 A.D.) the silver content of the denarius was reduced from 85 to 75%. If that sounds bad, by the reign of Claudius II Gothicus (268-270 A.D.) the silver content of the denarius was reduced to only 0.02%!

The consequences of this gradual debasement of the Roman coinage was that Roman citizens hoarded the higher quality silver and gold, trade shrank and eventually people preferred to deal via non-monetary means e.g. through gifts, bartering or feudal style economic arrangements.

Given the monstrous global debts, an ageing population and incessant demands of a modern welfare state, it is likely that future governments will carry on printing money (the 21st century version of debasing the currency) just like the Roman emperors. Cash is likely to remain used for day-to-day use for a long time to come, at least 50 years and more likely up to 150 years from now but it should not be considered a long-term store of value.

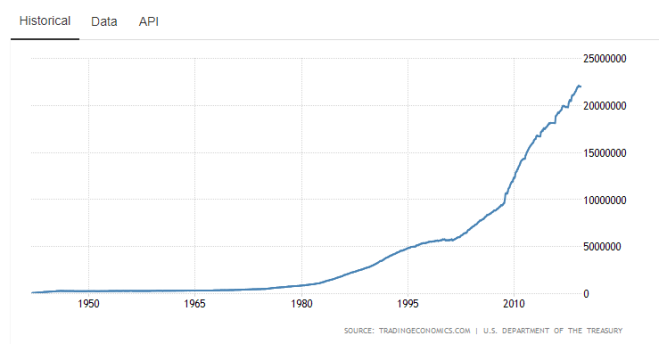

One of the main reasons successive Roman emperors resorted to debasing the coinage was the financial demands of the Roman military for money. Despite imposing excessive tax burdens on the productive classes of society the state couldn’t keep up with the spending demands of the ancient military-industrial complex. Does that sound familiar to you reader? American readers should be aware that America national debt is now over 20 trillion.

trading economics

The deficit – the gap between revenue and expenditure, is heading towards $1 trillion per year.

bipartisan policy

Politicians from the Left are increasingly talking about the so-called “Modern Monetary Theory” that justifies massive printing money by central banks. And politicians from the Right are de facto practising the theory in government.

The message to expect is that the real value of the paper money in your wallet or handbag will continue to lose its value over the coming century.

The deficit is also leading to increasingly aggressive attempts to seize assets from private citizens. Roman Emperors like Domitian (81-96 .D.) “…would use trumped-up charges to confiscate the assets of the wealthy”. Recently, Western governments have given themselves the powers to seize assets of the wealthy through Asset Forfeiture Powers. The UK London police last year seized assets from UK criminals worth £94 million.

In America, a growing source of revenue is the seizure of assets from citizens. According to the Pulitzer Centre, “the federal government took in $36.5 billion in assets police seized from people on America’s roads and in its poorer neighborhoods, many of whom never were charged with a crime or shown to have drugs.”

Is this any different to the ancient Roman practice of armed soldiers seizing assets from private citizens on trumped up charges? We are in the early stages of this process and it is likely to get far worse in the coming decades. Draconian wealth taxes and the arbitrary use of asset seizure powers by cash starved governments are increasingly likely and you should prepare accordingly. Already, capital is flowing into bitcoin – the 21st century version of gold – to escape restrictive government measures on capital.

Next decade, I expect to see wealth taxes introduced on the rich across the Western world which will drive capital further underground.

And as the experience of the Roman empire illustrates, it will ultimately be the middle to lower classes who will be worst impacted by this process wealth confiscation, inflation and higher taxation.

“As the private wealth of the Empire was gradually confiscated or taxed away, driven away or hidden, economic growth slowed to a virtual standstill. Moreover, once the wealthy were no longer able to pay the state’s bills, the burden inexorably fell onto the lower classes, so that average people suffered as well from the deteriorating economic conditions.”

Given the demographic trends of an ageing population, shrinking birth-rate and escalating national debts across the developed world the inflation and zero interest rates mega-trend looks likely to accelerate into the next decade.

Whilst economic forecasting remains a difficult art, the Investing Haven team have recently published an article noting that the next major stock market crash will be in 2022. Given the presidential cycle (usually presidents do everything they can to goose the economy prior to an election year), the mixed economic data and the renewed push by central banks to lower interest rates, this seems broadly right.

Whilst the stock market is elevated there seems little – outside the corporate debt, tech IPO’s and private equity/venture capital markets – of the euphoria you tend to see during the final stages of a stock market boom. Retail investors still shy away from stocks, having been burned by the 2008 crash and until they return the stock market should continue to rise into the 2020’s.

It seems to me that the course of the next 10 to 20 years will be periodic deflationary crashes, when asset prices temporarily collapse in value, before the central bankers and governments intervene by printing trillions to prop up the money economy. If Investing Haven are right, the next one is scheduled in early 2020’s – interestingly a time frame also mentioned by John Greer.

At some point around or after 2030, the world will be heading into a “perfect storm” of biophysical (resource scarcity and climate change), demographic (collapsing birth rates) and economic/geopolitical trends (collapsing economic growth and mass migrations from a dying MENA region).

The trends outlined above: wealth taxes, inflation and massive debasing of fiat currencies, asset seizures and growing interventionism into allegedly “free markets” by increasingly authoritarian states) will get far worse in the 2030’s and 2040’s. Politics will see a further wave of Caesars come to power across the world, on a bigger scale than our current decade, as frightened populations turn to strongmen for economic and geopolitical security.

One of the lessons of history is that the status quo can last longer than many realise. It is quite possible that in 2038, the news headlines could include a report on the rise of the stock market after QE25 had been announced, the rise of wages for skilled tradesmen due to the shortage of workers and the rising disorder in southern Europe struggling with a massive wave of migration from a climate troubled Middle East. That world is not dissimilar to 2019.

One of the lessons of the collapse of the Roman Empire is that the debasement of money eventually destroys the money economy. “People fled to the countryside and took up subsistence farming or attached themselves to the estates of the wealthy, which operated as much as possible as closed systems, providing for all their own needs and not engaging in trade at all.” At the same time, wealthy landowners developed their own militias to protect their estates and exert power as the Empire slowly disintegrated.

This trend of emerging war bands is a common pattern in a declining civilisation and if you look closely, proto-war bands are already lurking around the margins of our core industrial civilisation. The Mexican drug cartels whose tentacles reach deep into America, the jihadi militias operating in Libya, Syria and the wider Sahal and the fascistic Ukrainian militias fighting the Russians in the Donetsk are all future war bands.

If you think I’m exaggerating the UN envoy to Mali recently warned that the Sahal (the zone between the Sahara to the north and the Sudanian Savanna to the south) “… is becoming an open military arsenal. There are more than 60 million weapons circulating in the Sahal. If the Europeans and the other powers are not stopping it… will obviously contaminate Europe and contaminate the rest of the world”.

Eventually, these various dynamics will drive the collapse of the money economy and drag us into a world of non-market economic arrangements. In Roman times the State imposed a type of feudalisation of society where “…people were tied to their land, home, jobs and places of employment. Workers were organised into guilds and businesses into corporations called collegia. Both became de facto organs of the state, controlling and directing their members to work and produce for the state”. I can hear my readers already exclaiming this would never happen! Of course, this sounds remarkably similar to the state socialist model which collapsed in the late 20th century.

My point isn’t that it is a good system (it isn’t) but it is a functional system that has existed in our lifetime. It could reappear in the future. In 2010, the German magazine De Spiegel published a report by the Bundeswehr, the German military, into the implications of peak oil which you can read here. The secret report concluded that the security implications of a peak in global oil production would occur from 2025 to 2040. Shortages of petroleum would trigger, in the medium term, the collapse of the global economic system and every market-oriented national economy. More pertinently to our study of Roman history, the report predicted that “peak oil could lead to a ‘partial or complete failure of markets’. A conceivable alternative would be government rationing and the allocation of important goods or the setting of production schedules and other short-term coercive measures to replace market-based mechanisms in times of crisis.”

That, my friends, is how our free market economy slowly dies. Increasingly disruptive oil supply shocks going into mid-century which triggers the partial or complete collapse of market based economic arrangements around the world.

Recommendations

If you wish to avoid penury in the coming decades, which is the likely fate of the bulk of the middle classes of the developed world, I would recommend the following:

- Invest in scarce asset classes including a small fraction of your wealth in physical gold and silver (https://www.goldmoney.com/). Although cryptos are highly controversial speculative products I wouldn’t rule our also owning a small amount of bitcoin, ripple and other top cryptos with the intention of selling them once the market likely peaks again in the early 2020’s.

- Consider investing in fine wines (https://www.bbr.com/). Climate change is a serious risk to the wine making industry in France, Italy and Spain and as noted here, there is a reasonable chance that fine wines could grow in value due to the lower supply and increased global demand.

- Property is almost certainly overvalued but if you can afford it, there should be bargains to buy during the deflationary crashes which should periodically occur over the next few decades. Many of the rich Roman landowners acquired their vast lands by buying up bankrupt small farmers during the periodic deflationary depressions. Eventually those landowners and their descendants who survived the barbarian invasions during the Dark Ages became the warlords of the post-Dark Ages feudal era. Arable farming land (above sea level) is a good long-term investment along with quality buy-to-let properties.

- Blue-chip stocks are still worth holding, given that central banks are likely to try and prop up financial markets for many years to come. However, I would largely avoid government and corporate bonds which seem to be particularly leveraged to permanent economic growth.

- Consider investing in quality, sustainable and well-run local businesses that provide a real good or service to the local economy. Greer has written before that every era of globalisation ends with a lurch back towards localisation and protectionism. That local brewery might be a sound investment which should survive the economic and geopolitical disruptions of the coming decades.

- Develop your own skillsets and income streams in the real world. That could include massaging, gardening, DIY, brewing beer or anything else that can get some cash-in-hand or bartered favour with a neighbour, friend or colleague. As the money market economy slowly dissolves, these informal networks and skills will become increasingly useful for most of us outside the privileged circles of the wealthy.

The key takeaway from this post is that our world is changing fast and only those who adapt will survive and thrive in the coming decades.