JP Morgan predict a huge oil supply gap by 2030 and a decade of triple digit oil prices

The headline in the zero hedge spells it out “JPM Upgrades Energy To Overweight As “”Supercycle Returns”, Sees Oil Upside To $150 And “Multiple Energy Crises” This Decade”” with a graph showing by 2025 a roughly 1 million supply gap in global oil supply morphing into a 7 million expected oil supply gap by 2030.

Essentially what is happening is the big banks and analysts are starting to clock what others on the fringes have been saying for years. We are facing a major supply crisis this decade and triple digit oil prices are our future.

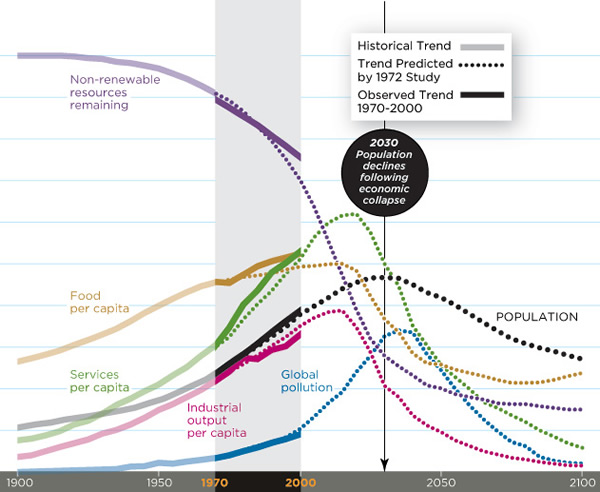

Should we see anything close to a 7 million oil supply gap in 7 years, that will be a devastating blow to the global economy. All very much in line with LTG BAU modelling of a massive fall in industrial per capita in the 2nd half of this decade.

A war of attrition in Ukraine with Russia tilting the odds in its favour

Ukraine has fought bravely and with real stamina but the facts on the ground, as now admitted by the New York Times, suggests that the war of attrition is slowly but surely tilting in Russia’s favour. Whilst I probably under-estimated both Ukraine and the West’s resolve in the 1st year of the war (along with the weaknesses in the Russian side) my outlook in the medium term hasn’t really changed. I expect Russia to “win” – at major costs to itself – but what precisely that means remains to be seen.

2024 is likely to be a big year with talk that the Russians will try their own major offensives that year. Will they be more successful this time around? Can Ukraine recruit a new army to replace the one dying or getting maimed right now? What about wider Ukrainian resolve? All good questions that I don’t have any definite answers to.

Why diesel is the lifeblood of an industrial economy

Superb article I discovered recently. What caught my attention was this paragraph:

“According to the EIA distillate fuel oil consumption by the transportation sector peaked in 2007. After growing for more than 30 years it has crashed in the wake of the 2008/2009 financial crisis and has failed to recover ever since, despite a 12% growth in US population (theoretically demanding more food, products and services). Consumption per capita was thus stagnating ever since the great financial crisis, and has been clearly trending downwards since 2019 — with no end in sight. The average citizen, as a result, got poorer, more exploited and less resilient, while the well-to-do, well, became even more well-to-do — but only on paper. Their actual consumption did not appear to grow in line with their wealth.”

Perfectly in line with LGT BAU modelling! So folks, if you want to see the future, check out the LTG BAU model and see where we are heading!

So what am I doing as I track what seems to be the inevitable drop down the Long Descent as captured by the above model? Well, I’m focused on paying of my debts in anticipation of a major economic crisis coming around the mid 2020s onwards.

I also expect inflation to return in the mid 2020s and probably an even worse inflationary spike towards the end of this decade.

I’ve just installed solar panels and I’m looking at a home battery system once the tech improves (I expect that to kick in around 5 years from now).

I carry on developing my “developing world/1970s” food habits, more soups, rice and bean dishes and so on using local and garden produce as much as possible. I’m also using a local 2nd hand shop for most stuff I need rather than buying new. It is saving us as a household a fortune! These habits are normal in the majority of the world and its time we in the “over-developed” world start them as well! As Greer says “collapse now and avoid the rush!”.

And finally, I’m playing the commodities super cycle this decade. Investing in cheap and quality commodities stocks that will rally in a otherwise challenging market decade. My very basic macro outlook is the US equity markets (and possibly others as well) peaking around 2025, with cryptos peaking around the same time, and after that a protracted slump, partial recovery going into the late 2020s before a 1929 style collapse in assets globally at the end of this decade.

My game plan remains focusing on commodities and to a lesser extent crypto, and buying, when cheap, high quality dividend blue chips in “essential” industries like farming, mining and so on for a long term buy and hold (and enjoy the dividends).

Well, that’s it for this time. Any questions send them though as I’m happy to answer questions.