The global macro landscape continues to evolve in fascinating ways. Here are the best links I came across recently that you might find interesting:

“With the crisis in the South China Sea now more or less permanent, the lack of mission-capable ships is the main reason why last December the Navy dedicated a remarkably small strike group to Operation Prosperity Guardian in the Red Sea, consisting of one aircraft carrier and three escorting destroyers. The British provided one destroyer, while Denmark and Greece promised a frigate each. The Netherlands, Norway, and Australia are together sending two-dozen military personnel in all, but no vessels. Singapore’s navy is providing a center “to support information sharing and engagement outreach to the commercial shipping community.”

This amounts to an utter debacle, effectively the U.S. has zero contribution from all but Britain. Australia’s refusal to send ships is a particularly unpleasant shock to the administration. Some nominal members of the operation have even refused to announce their participation in public for fear of being linked to Israel and suffering military or terrorist reprisals.

U.S. military bases in the region—notably in Bahrain, right across the Gulf from Iran—appear potentially more vulnerable than ever before.

Coupled with the looming defeat of the Armed Forces of Ukraine, likely followed by a major Russian offensive come summer, the global mix is becoming volatile in the extreme.”

The Sun Sets Slowly – then quickly

“America is a naval empire. It, like the old British empire, rests on being able to keep the shipping lines open and on using naval power (and air power) to hurt nations while those nations can’t fight back. In the 19th century the Brits would park ironclads off the coast and just pound cities, and there was nothing those cities could do in return.

This is, then, one of the key moments in the end of Western hegemony. The point at which we no longer have deterrence; at which we can no longer “big foot” other nations.

The end of Western dominance is close, very close. I can taste it, like a hint of salt on a sea breeze. The Chinese are only behind in a few technological areas. Once other nations can get everything they need from China/Russia and other lesser nations they will be free to throw off the Western order, because the new and improved missiles make “stand off and bomb” far less effective than it used to be.”

NATO warns of all-out war with Russia within 20 years

“Civilians must prepare for all-out war with Russia in the next 20 years, a top Nato military official has warned.

While armed forces are primed for the outbreak of war, private citizens need to be ready for a conflict that would require wholesale change in their lives, Adml Rob Bauer said on Thursday.”

Growing talk about bringing back national service and a return to a war economy across Europe now. The war drums are starting to beat louder and louder.

UK defence minister warns of regional wars in 5 years

UK minister warns the world is in a pre-war era and should prepare for wars against Iran, Russia and China in 5 years (e.g. 2029).

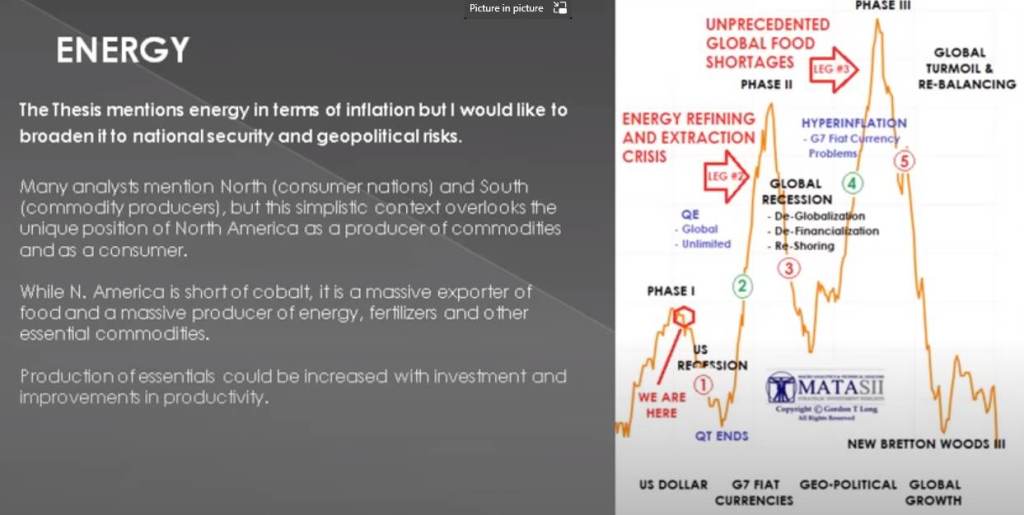

Obviously, the risks of regional wars across the world will shatter the global economy and the globalised supply chains.

All this seems painfully like the updated LTG BAU model doesn’t it? And note it all unravels from the mid-2020s onwards, around the time US shale is supposed to peak and rollover…